The Blaze

The White House on Friday released President Barack Obama and Vice President Joe Biden’s tax returns.

“Today, the President released his 2012 federal income tax returns,” White House press secretary Jay Carney wrote in a blog post on the White House website. “He and the First Lady filed their income tax returns jointly and reported adjusted gross income of $608,611. The Obamas paid $112,214 in total tax.”

“The President and First Lady also reported donating $150,034 – or about 24.6 percent of their adjusted gross income – to 33 different charities,” Carney said.

Here are five interesting things we discovered about the Obamas and Bidens via their 2012 federal income tax returns:

5. President Obama’s Income Has Declined

“President Barack Obama made less in 2012 than in any other year since taking office, with about 40 percent of the nearly $609,000 in income that he and first lady Michelle Obama reported coming from book sales,” the Associated Press notes.

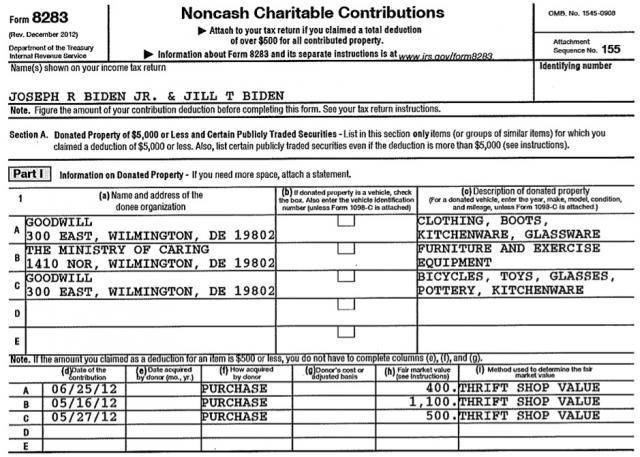

4. The Bidens Donated $2,000 Worth of Clothing, Boots, Toys, Pottery, etc. to Goodwill

“A look at the Bidens joint filing reveals that $2,000 of [their $7,190 to charity in 2012] was in the form of ‘donated property’ given to Goodwill in Wilmington, Delaware,” the Weekly Standard notes.

“[O]n June 25 of last year, the Bidens gave ‘Clothing, Boots, Kitchenware, Glassware’ totaling $400 to Goodwill,” the report notes. “Earlier, on May 16, the Bidens gave ‘Furniture and Exercise Equipment’ valued at $1,100 to the Ministry of Caring. And on May 27 of last year, the Bidens gave ‘Bicycles, Toys, Glasses, Pottery, Kitchenware’ valued at $500 to the same Goodwill.”

3. Vice President Joe Biden Received $30K in Social Security Benefits Last Year

Yes, on top of the Biden’s combined income of $385K, Vice President Joe Biden collected $29,761 in Social Security in 2012, according to his tax returns, which is more than double the amount the average retired worker collected last year.

2. The Bidens Increased Their Charitable Donations to 1.87 Percent of Income

‘This year, Joe and Jill Biden increased their charitable donations from 1.5 percent of their income to 1.87 percent,” the Weekly Standard notes, citing Carney:

The Vice President and Dr. Jill Biden also released their 2012 federal income tax returns, as well as state income tax returns for both Delaware and Virginia. The Bidens filed joint federal and combined Delaware income tax returns. Dr. Biden filed a separate non-resident tax return for the state of Virginia. Together, they reported adjusted gross income of $385,072. The Bidens paid $87,851 in total federal tax for 2012. They paid $13,531 in Delaware income tax and $3,593 in Virginia income tax. The Bidens contributed $7,190 to charity in 2012,” writes the White House, summarizing the Bidens’ income tax return.

1. President Obama Pays An Effective Tax Rate of 18.4 Percent

“President Obama and First Lady Michelle Obama reported an adjusted gross income of $608,611 for 2012 and paid an 18.4 percent income tax rate,” the Washington Examiner notes.

“In total, the first couple paid $112,214 in taxes last year,” the report adds.

Here are the Obamas’ tax returns:

Complete Return President Obama 2012

Hmmm. Donated to charities? Yet he was offered $5 million for a charity if he could produce simple specific items.

He did not provide them.

How was Biden able to receive over $29,000 in SS?

Well he is getting much more than a 100% disabled vet.