Tyne & Wear Archives and Museums Just watch me June 9 1902

Fron album of prisoners brought before the North Shields Police Court in England between 1902 and 1916.

Time has stopped before us

The sky cannot ignore us

No one can separate us

For we are all that is left

The echo bounces off me

The shadow lost beside me

There’s no more need to pretend

Cause now I can begin again.”Smashing Pumpkins, The Beginning is the End is the Beginning

Ashvin Pandurangi: The latest revolution of the Euro Crisis Cycle has brought us back to talks of restructuring Greek sovereign debt through “Private Sector Involvement” (PSI), which are somehow taking place in a Universe where debt restructuring is not allowed to be confused with “debt default” or “bankruptcy”. On Friday January 20, the IIF (representing some of Greece’s creditors) and the Greek government announced that they had finally reached an “agreement” on the basic structure of the restructuring (or the basic restructuring of the structure?).

Here’s the live blog update from The Guardian on Friday, which really stood out to me:

A framework of the deal — the basic structure of the bond swap that the Greek finance minister Evangelos Venizelos wants to present at Monday’s eurogroup meeting — has been accepted by both sides, “put in place” and I understand committed to paper.

But it would also seem that other aspects of the agreement – be them legal, technical or matters of substance — remain unresolved and will be discussed at negotiations that resume at 7:30pm local time [6.30 GMT] and look set to continue over the weekend.

If Greece’s massive €360 bn debt load is to be made manageable much will depend “on the inter-related role of all the interests at stake” insiders say. Even if a decisive agreement is reached, the proposal will have to be put to technocrats — given the complexity of the deal — and they could very likely change it again.

“The outline won’t be the end of the beginning but the beginning of the end,” said another source again requesting blanket anonymity because of the delicacy of the talks.

That’s how these anonymous blankets, with their linear mindsets and scripts, really think about the process and justify the charade to everyone else who looks on in anticipation. We have not reached the end of the beginning, but the beginning of the end! Or is it really the beginning of the end of the beginning? Let’s just go ahead and say that the end is the beginning, which is also the end. It’s a circle, a cycle, a never-ending series of revolving points; an optical and psychological illusion of mass proportions.

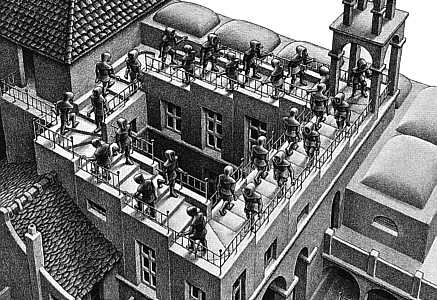

M.E. Escher – Up and Down

Of course, not more than two hours after the live update from above, I stumbled across another live update from The Guardian that, in combination with all the reports over the course of just one week, was starting to make the Escher Stairs look like a straight, non-stop, round trip flight from Athens to Brussels and then back to Athens… and then back to Brussels.

“At the risk of just adding to the confusion over what is or is not happening with the discussions between Greece and the private bondholders, CNBC is reporting no deal has been reached on the terms of a debt swap. Nor is there apparently a press conference planned for tonight.

However that does not rule out the idea that a framework has been agreed, and further details will be hammered out over the weekend, as we reported earlier.”

So now we should just be glad that we can’t “rule out” the possibility that a framework has been established to “hammer out” further details in upcoming days. What all of this really means is that there are way too many vested interests fighting over the pieces of the same wealth pie which is continuously dwindling in size, and it will take way too long for them to actually sign their names to an agreement that is suitable to all interested parties, as opposed to continuously cycling rumors of “progress” being made.

But, alas, even the framework of a deal didn’t last past Saturday, as the parties involved kept making right turns until they came full circle to the point of “stalled talks”. Here’s a report from Dow Jones on Saturday January 21, via ZeroHedge:

Talks between Greece and its private sector creditors over a debt writedown plan appeared to stall Saturday as the banks’ top negotiator left Athens amid signs of fresh disagreements over how much Greece would pay its bondholders in the future.

Officials close to the talks said they may not conclude before a meeting Monday of euro-zone finance ministers where a second bailout which will keep Greece from defaulting is supposed to be discussed. Without a deal on the write-down of the debt held in private hands, the loan can’t be released.

Institute of International Finance chief Charles Dallara, who has been negotiating with Greek officials on the bond swap plan for the last two days, left Athens Saturday as hurdles remained over the interest rate the new bonds would pay private sector creditors.

“Right now there are no talks. There will be consultations with the EU and the IMF to determine where we stand and then we’ll see. It (negotiations) has again become complicated with the new demands over the coupon,” said a person with direct knowledge of the talks.

And here’s Paul Anastasi and Farry White from The Telegraph with a similar report, except with a slightly more optimistic spin, courtesy of official “spokespersons” from the IIF and Greek government.

Charles Dallara, managing director of the Institute of International Finance (IIF), a lobby group representing private creditors who have lent €47bn (£39bn) to the Greek government, has so-far failed to reach agreement on the key interest rate of the new bonds Greece will issue.

Athens was anxious to strike a deal ahead of a meeting of eurozone finance ministers on Monday, which could have set in motion the paperwork and approvals necessary to give Greece its next tranche of aid, worth about €130bn.

This will prevent a disorderly debt default when €14.5bn of Greek bonds mature in March. However, Greek government officials said on Saturday that the crisis talks had now been postponed for a few days.

A spokesman for the IIF said that Mr Dallara had travelled to Paris for a long-standing social arrangement and his departure was “in no way a reflection on the talks”. The talks have made “substantial” progress, the spokesman said, noting that Mr Dallara was in phone contact with the Greek prime minister and could return to Athens at any point.

International private creditors have already accepted a 50pc “haircut” or loss of their investments in Greek bonds, a move that would cut €100bn from Greece’s €360bn debt pile. However, the sticking points appear to be the term to maturity of the new replacement bonds and the rate of interest, or coupon, that they will pay.

“We are now expecting a solution in a few days,” the Greek government official said. “Nobody expects a failure, as that could raise the spectre of a default. But it would have been convenient to have wrapped things up this weekend, because of the simultaneous presence in Athens of the Troika.

Not much commentary necessary, right? “Back to the drawing board” would imply that they had actually managed to upgrade from the drawing board to some more concrete stages of action, so that doesn’t work. The talks allegedly continue, but the questions of about what, between whom and to what end are all blowing in the wind. These PSI talks, and the Eurozone in general, are still stuck in the depths of an Escher diagram, where every ounce of “progress” is simply a function of some Eurocrat and mainstream media outlet declaring it to exist.

No one wants to accept the fact that, until the entire system is fundamentally transformed (through disorderly collapse or otherwise), this vicious crisis cycle will never end. The Greek PSI negotiations are a perfect example of the hamster wheel that is Europe. In theory, it is both necessary and just for private creditors (mainly banks) to take large haircuts on the net present value of their Greek bond holdings. But as long as the “restructuring” is treated as a means to avoid outright default/bankruptcy, stabilize the structurally imbalanced Eurozone and continue business as usual in the future, it will fail to produce any meaningful results.

You simply can’t satisfy all of the vested parties in a fundamentally broken and collapsing system. After a prolonged period of running around in circles, someone is bound to crash into someone else. The revolutions of the Euro Crisis Wheel are bound to spark an actual revolution that forces the system to do that which is unspeakable – change. It is now starting to look like the disorderly Greek default in March (there is no “orderly” version), which was always inevitable but never until now capable of being marked on a calendar, will be the event that sets that particular ball rolling.

Let’s face it – even after a credit market “rally”, the Greek government is paying close to 400% for a year’s worth of money. The hold outs in the PSI right now are the hedge funds who have loaded up on Greek bonds and CDS insurance, as they figure it is better for them to try and get paid out in full on one or the other than agree to “voluntarily” participate in the swap deal and relinquish their rights as bondholders. Indeed, this literal leverage has given them a degree of negotiating leverage that was certainly under-estimated by the mainstream until now.

If they do not take place in the debt swaps, then they can avoid taking a haircut on their bonds, and if they are “coerced” into a restructuring by retro-actively inserted “collective action clauses” (allows a majority of creditors to override the minority), then the CDS most likely get triggered. On top of that, ZeroHedge just produced a lengthy and complex report that describes, among many other things, the various other implications of a retro-active change of local law.

Before we, like Reuters and like JP Morgan, accept that even the local-law debt can be crammed down, we point readers to a seminal paper by none other than Lee Buchheit, the same one who is currently advising Greece on its bankruptcy negotiations (to call a spade a spade), called How To Restructure Greek Debt from May 2010, in which he says the following:

[Buchheit] ‘No country in Greece’s position would lightly consider a change of local law as an easy method of dealing with a sovereign debt crisis. The following factors, among others, counsel extreme caution before embarking on such a remedy.

• If done once, future investors will fear that it could be done again. The debtor country may therefore be compelled in future borrowings (in which international investor participation is sought) to specify a foreign law as the governing law of its debt instruments.

• A dramatic change in local law by one country might allow a worm of doubt to slip into the heads of capital market investors in other similarly-situated countries, driving up borrowing costs around the board.

• The official sector supporters of the debtor country will presumably balk at any action of this kind that could unleash the forces of contagion and instability upon other countries whose debt stocks also contain predominantly local law-governed instruments.

• The more dramatic or confiscatory the effect of the change of law, the higher the likelihood that it would be subject to a successful legal challenge.

The report also describes how a stripping of the creditor protections offered by Greek bonds issued under U.K. law, which contain CACs and have been accumulated by these holdout hedge funds, will probably have even more severe implications for sovereign bond markets around the world. We should also remember that no one really knows what the knock-on effects of CDS triggers would be throughout the global financial system, since it is entirely unclear how many billions worth of derivatives have been written on Greek debt.

It’s really the space between a huge, jagged rock and a very hard place for just about everyone involved, as it has always been. Besides the two direct parties involved (Greece and its creditors), we also have the European Commission, ECB and IMF, who obviously don’t want the Greek government to compromise to the point where no meaningful debt reduction is made and they are simply writing checks (endorsed by Western taxpayers) to both the Greek government and its bondholders for nothing in return. English language Katimerini reports a bit on this angle:

Talks between Athens and the steering committee of private creditors concerning the Private Sector Involvement plan (PSI+) will resume by telephone on Sunday as the committee’s head, Charles Dallara, left Greece unexpectedly on Saturday.

According to reports on Skai radio the International Monetary Fund, the European Commission and the European Central Bank are not happy with the provisional agreement between the Greek government and its private creditors, as they believe it does not secure the sustainability of the Greek debt.

As a result Dallara, who is also the head of the Institute of International Finance flew to Paris on Saturday to discuss developments with lenders and funds which hold the bulk of the privately-held Greek bonds worth 206 billion euros.

Finance Minister Evangelos Venizelos told reporters on Saturday that negotiations would continue on Sunday by phone.

Both the IIF and the government have leaked that there is progress in the talks but any agreement would require the approval of Brussels, Berlin and the IMF.

Sources suggest that the Greek side proposed to private creditors a 3.5 percent interest rate for bonds maturing by 2014, 3.9 percent for those maturing by 2020 and 4.6 percent for those expiring after 2021. There will be a 10-year grace period and the new bonds will be under British law.

Reuters cited an unnamed source saying that “things are complicated, we are getting closer on the numbers but there is still quite some work ahead. An agreement is unlikely before next week, if there is an agreement at all.

For argument’s sake, though, let’s say the Troika, the Greek government and the holdout creditors manage to come back full circle (via telephone conference) to “progress” being made and a deal “nearly within reach” in the next night or two, and then put an actual deal to paper. What will that mean for the Euro Crisis Cycle? Simple – it will continue rolling on in a broader and more devastating fashion. First of all, Greek debt will still not be sustainable in any meaningful sense of that word, as this comprehensive report from Barclays makes clear (via ZeroHedge).

6) Does the PSI in its current form make the Greek debt sustainable?

The October Troika debt sustainability report highlights that the current PSI with nearly universal participation gets debt/GDP close to 120% by 2020.

First, this number is still on the high side to conclude that Greek debt is sustainable. Second, the underlying macroeconomic assumptions by the October Troika report in terms of GDP growth and primary balance post-2015 are still optimistic (c.3.8% average nominal growth and average 4% primary balance).

If these macroeconomic assumptions are reduced to a more realistic 2.5-3%, then the debt sustainability picture would look much worse. As seen in Figure 1, a 50% national haircut with 50% participation does not get Greece close to 120% debt/GDP by 2020, as envisaged even with the relatively optimistic macro economic assumptions of the Troika.

Only if 100% participation is achieved would close to a 120% debt/GDP target be reached. For this reason, the Troika does not want to sacrifice universal participation and is determined to do whatever is necessary to maintain it. When worse macroeconomic assumptions are used, the notional haircut needed for a reasonably sustainable debt path is about 80%.

Therefore, if Greece and the Troika go ahead with October summit broad parameters for the PSI, even with 100% participation Greek debt is not likely to be sustainable in the absence of substantial fiscal and structural adjustment by Greece in the years ahead.

That’s right – even if 100% of private creditors participated in the proposed debt swap arrangement for a 80% haircut to notional value (not going to happen!), Greece’s debt would still remain at entirely unsustainable levels for many years to come (and that’s assuming a 100-120% debt/GDP ratio is the threshold for sustainability). Secondly, the Greek situation is obviously only one piece of a much larger puzzle in Europe. Peter Tchir remarks on those other debt-swamped Eurozone countries who sure would love to have some “voluntary debt swaps” of their own.

“So it looks like we should get an announcement sometime today about the proposed Greek PSI deal. Yes, proposed, not finalized. Asides from the obvious fact that there will be limited or no documentation for the deal, we still have no clue who has agreed to what.

As far as I can tell, no one has given the IIF negotiators any binding power. Obviously some of the institutions that the IIF negotiators are associated would have trouble not approving the “deal”, but how many bonds do they really represent?

I think this will be a relatively small portion of bondholders and then the real game begins. The carrot and stick that the EU and ECB can use with other holders and the desire to maximize profits (or minimize losses) on the other side. So far, this news seems to be acting inversely to the “downgrades” price action, as early front-running is meeting sell the news.

If the terms of the deal being leaked are true, it will be extremely interesting to see what other countries do. Not only will Greece receive a 50% notional reduction (except from the ECB and other “public” holders), but they will get very long dated money at very low rates. Who wouldn’t want that?

Why should Spain be going through semi-legitimate auctions when Greece can get longer dated money at lower rates? Why should Portugal or Hungary bother with painful steps to reduce debt when the alternative is spend more, reduce debt via restructuring, and get lower rates on that reduced debt?“

There is absolutely no way that European private banks can afford to take another 50-100% haircut on the bonds of Portugal or Ireland on top of Greece, let alone Spain or Italy. Any attempts towards such an outcome would be even less “voluntary” than the Greek swaps, and that’s really saying something. And who would even want to buy the bonds of these countries after the most coercive restructuring in history just took place? This time it was a few hedge funds that have brought us to the brink of potentially catastrophic debt deflation, next time (if there is one) it will be a much broader force of resistance.

The economic, financial and political divides within Europe will simply deepen to the point where the internal hemorrhaging overwhelms any and all top-down “solutions”. So IF this Greek PSI deal is finalized soon, the IMF bailout money is disbursed and Greece gets through the next few months, the focus will simply shift back to those equally troubled and much bigger debt issuers across Europe (and perhaps the world). We’ll be right back at the end of the beginning or the beginning of the end, depending on which way the crisis propaganda decides to spin on any given day.

SUMMARY

HOW TO REVERSE WORLD RECESSION IN MATTER OF DAYS

A Method to Address Economic Recession, Remove Poverty, Terrorism, Improve Law and Order, Reduce Drug Abuse, Inflation And Taxes in an Interest Free Based Economy.

By: Dr. Niaz Ahmed Khan, FRCS, PhD

ABSTRACT:

I have developed a new financial instrument which will be much more valuable than the bonds or the treasury bills government sells in the open market to raise much needed funds to run the country. These are all interest based instruments and can only be used by institutions. The instrument I am proposing is without interest and will be used by everybody to purchase goods and services in the government and private sector resulting in up to 60% discounts. This is why these will be massively bought up front in large amounts in the shortest period of time of one month to run the country for at least a year and much more by the end of the year.

SUMMARY OF THE BOOK:

The world is facing many challenges with no solution in sight.

The main cause of all these ills is the POVERTY. Float bonds which can be used by everybody rich or poor and are not debt to the state so there is no question of interest.

How: Take the example of USA which is going through a great recession.

USA borrows money by selling treasury bills and the interest based bonds. The suggestion is to sell these bonds on non interest basis.

1. Buy all goods and services under govt control with these bonds and these bonds will replace dollar with bonds.

2.10 million duty waved off.

3.100 million dollars prize draw from the bonds held by the public every day.

EXAMPLE: ONE dollar buys 5 bonds on the condition that the amount should be $100,000 or multiple of it. Fewer amounts will get the rate of four and three. This massive discount period is only for first month at the start of the implementation of this system. In the second month the rate will be 4 but the rate of 3 will apply to subsequent months for the same amount.

WHERE THESE BONDS WILL BE USED?

1. All state controlled services and commodities.

EXAMPLE: A bill of (any service or Commodity) $100 can be paid with 200 bonds and there will be no exception to this rule. A NET DISCOUNT OF 60%.

A simple formula will apply: Total bill in dollars x2 is the number of bonds surrendered. Price in bonds will not be less than the cost price but without the direct indirect taxes and the duties which are added to the present cost to make it very expensive.

It will attract at least 50 million people to take this opportunity as early as possible. And if one is sure of making 100% profit within 30 days there will be many more that will help themselves.

RESULT: Government gets at least $5 trillion within a very short period of time of few days and much more in the rest of the year. THIS IS NOT A DEBT AS STATE HAS SOLD BONDS (Commodity) WHICH IS AN ALTERNATE CURRENCY AND DO NOT CARRY ANY INTEREST. One immediately thinks who will bear the loss and this loss to the state will not be more than total year budget of $2.5 trillion which it collects in one year with all the taxes and the duties but the bond price is simply a cost price without any kind of tax or duty. So there is a net gain of approximately 2.5 trillion within a short period of time. First floodgate of money has been opened.

WHO WILL SELL THESE BONDS?

State will float tenders to select a private agency (USMF) UNITED STATES MONITORY FUND JUST A NAME GIVEN TO THIS ORGANIZATION with the lowest bid WHERE AS second, third and fourth bidders will be auditors of USMF. This agency will employ at least 20 million unemployed on 10% commission basis and without any salary. These agents will have to pay $500 as an annual fee to USMF in order to build the infrastructure for the sale of bonds. Agents’ quota will be $300,000 per month or they will be allowed to sell their whole year quota in one day or in a month. This will only materialize if the agent shares his commission with the buyer. Greater the share of commission quicker the sale. The investor or a buyer will sell these bonds at the same rate of 5 per dollar and his bonds will sell like hot cakes every day as there is no condition of the amount of money to purchase the bonds. In this way even the poorest person will get the same or near the same rate as the investor earns a profit from the commission which he takes from the agent and makes almost 100% profit by only investing $100,000. He will sell these bonds repeatedly and will keep almost 6% profit every day till the demand lasts. NOW THINK HOW MUCH FUNDS STATE HAS ACCUMULATED Much more than few years budget in matter of only one month.

FLOOD GATES OF MONEY AND TURNING POINT

This is the second flood gate of money and there are still four more floodgates of money yet to open. So at the end of 30 days or even much earlier the government declares tax free country for ever. With the removal of all kinds of direct and indirect taxes and duties the price of oil electricity telephone and of all other services under government control is now almost 60% less than before as these are being purchased by bonds (which is the cost price) and not with dollars. The production cost of everything has come down tremendously.

SECOND OPTION

STATE ALSO OFFERS 10 MILLION DUTY FREE IF ONE DEPOSITS $100,000 NON REFUNDABLE. THIS BRINGS OUT ALL THE BLACK AND SPARE MONEY WHICH STATE WAS NOT ABLE TO GET BEFORE AND AS THERE IS NO TAX AND HENCE NO TAX EVASION SO ALL THE MONEY IS WHITE AS IT IS BEING GIVEN TO GOVERNMENT.

This was the third floodgate of money which is even bigger than the first one and the exact amount is impossible to asses unless the system is implemented.

In order to provide cheap bonds throughout the year government offers three types of registration fees.

1. Pay $100,000 in the start of the year and get the rate of 5 for the rest of the year and this will suit the professional’s and salaried person’

2. Pay $10,000 yearly and get 20,000 new bonds at the rate 5 every month but one has to collect 10,000 bonds (equal to fee) to get this cheap rate throughout the year. Higher the registration fee more the entitlement of cheap bonds. This registration will suit any small time business who will sell his product cheaper provided 15% bonds are also paid with rest of cash money by the customer SEE THE NEXT REGISTRATION FOR FURTHER EXPLANATION OF15%BONDS. This will apply to all goods in private sector and does not apply to the government sector. This is a big incentive to accept bonds in the private sector as the business accepting more bonds will have more business than the trader not accepting the bonds so the bonds market will multiply and there will be a constant need for bonds in the open market.

3. Third type of registration will be of $100,000 which will entitle the business to sell its products through USMF. The value of merchandise sold through this source will help the business to get the 5 bond per dollar rate or opt for the duty free option equal the amount sold. But with one condition of surrendering 15% bonds at each sale in dollars.

EXAMPLE:

MERCHANDISED SOLD THROUGH USMF $1000. BONDS SURRENDERED 150 ARE DEPOSITED IN STATE ACCOUNT TO BE SOLD AGAIN SO THE CYCLE OF BONDS IS ESTABLISHED .A receipt of bonds surrendered is obtained from USMF for evidence of sale of merchandise and this receipt will entitle the traders to get cheap bonds or the duty free option throughout the year BUT THE SAME RECEIPT CAN BE USED ONCE ONLY.

WHAT IS THE BENEFIT TO BUSINESS?

1. CHEAP BONDS THROUGH OUT THE YEAR

2. DUTY FREE OPTION WILL HELP INDUSTRY.

3. The quota which can be sold is ten times the amount of Registration but not more unless the registration fee is increased. Now all the business will opt for this registration in order to reduce the cost of production. These 15% bonds the business will get back through a chain of dealers sub dealers and ultimately the customer will pay this bond portion as he will get the end product very cheap because of tremendous cut in the cost of production by the factors already mentioned. This will replace the GST or the VAT or the two price system seen all over USA. Almost everybody will sell their product through this channel as it will be much costlier to sell the product outside this system as cheap bonds are not available otherwise.

According to rough estimate at least $10 trillion transactions are carried out every day in US and at each transaction 15% bonds are being surrendered, the price 15 bonds is $3. So 3% of 10 trillion will be $300 billion which goes into government account without any compulsion every day (UNBELIEVABLE). This is the fourth floodgate of money AND IS CALLED THE GOLD MINE. Now the state is sitting in the driving seat and all the money in banks of private sector has been transferred into government account and banks are no more the lenders but are borrower from the state which is the only source left and will invest in business with sound feasibility study checked by the state bank. The state will offer to invest 80% and the bank will bring investor who is willing to pool rest 20%. This 20% will be deposited in the bank and the bank will oversee the running the business, running expenses will be given to the investor from its share of 20%. There will be no collateral and share of the profit and loss will be shared in the ratio of 60 and 40. The bank will share the 60% with the investor and 40% will go to state funds and the state will provide everything under its control below cost which will farther reduce the cost of production and at the same time will MARKEDLY improve the profit margins OF ALL THE BUSINESSES. No major business can refuse this offer. Any bank showing repeated loss will go out of business as there will be no more funds available from the government source and all other interest based sources are not available any more. Interest based banking is gone forever or it may be at a very small scale and the state will not offer loans on interest as these are not any more profitable and risk free as there is no collateral. The amount of profit government will share will be unimaginable and this is the 5th flood gate opened.

THEN WHY NOT INVEST ON PROFIT AND LOSS SHARING BASIS

Last but not the least government will acquire all the land on lease without any force and will provide all the needs to the formers THROUGH CORPORATE FARMING SECTOR HIRED BY THE STATE below cost and will become the shareholder according to the mutual contract with the land owner this is the 6th flood gate of money opened.

DRUG ABUSE ELIMINATED

When all the possible land is being cultivated by best agriculture engineers there will be much better yield and much more profit to land owner then who will not join hands with the government.

THE OBVIOUS BENEFIT WILL BE NO MORE POPPY CULTIVATION IN COUNTRIES WHICH ARE POOR AND LARGELY DEPEND ON THE POPPY CROP. NOW THERE IS NO MORE POPPY AND NO MORE DRUGS.

All the above claims have been proved to be true except the terrorism.

HOW TERRORISM WILL BE ELIMINATED?

We have to look at root cause and it is POVERTY and NOT the religion which is being falsely blamed. The going rate for a suicide bomber is $1,000 in Pakistan, Iraq and in Afghanistan. Can one believe that anyone having at least two meals a day will blow himself? Never the areas of the countries where these attacks are happening are extremely poor and the extremist elements who themselves are or were poor exploit these very poor people to carry out attacks for money to save their families dying from hunger and this is an open secret. Extreme elements has large force that is recruited from poor areas as there in no job anywhere and they provide these raw recruits with only food and shelter and at same time brainwash them and train some of them to carry out these attacks by giving them enough money in their lives to support their dependents. You might mention few isolated cases of being well to do and still carried out these attacks. Once the poverty is removed in these areas by implementing this system these attacks will come to an end immediately. This system is not only meant for USA but will be easily applicable to every country.