Damon Geller | wholesaledirectmetals

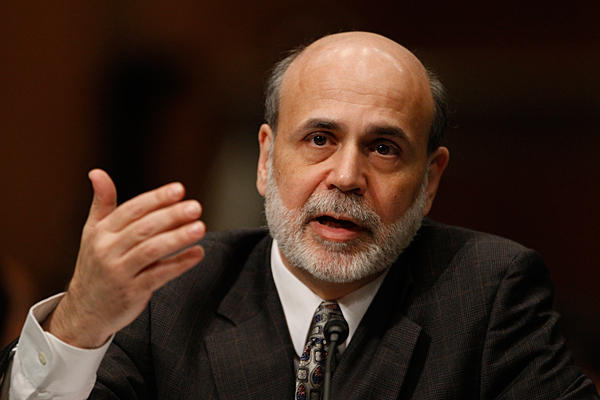

Now that QE3 has arrived, it’s more obvious than ever that a few powerful men have hijacked our economic, financial and political structure. And here’s a news flash: They aren’t socialists or capitalists. They’re criminals. The latest round of stimulus policy by the head printer-in-chief, Ben Bernanke, and the Fed is stunning in its size (in that it has no limit), stunning in its time-frame (as there is none), and even more stunning in the lie behind what it’s designed to accomplish. The bottom line? The Fed has just guaranteed $6 gas and $4000 gold.

Let me explain. In this latest round of “monetary stimulus,” the Fed will be buying $40 BILLION a month in MBS (Mortgage Backed Securities) until the “labor market improves.” That is on top of the already large treasury purchases they make. That means, assuming the labor market doesn’t improve, the Fed will expand its balance from an already insane $2.8 trillion to an inconceivable $4 trillion by the end of 2013.

Bank of America analysts are saying the Fed’s balance sheet may pass $5 trillion by the end of 2014 sending gold to $3550 and oil $190 a barrel. While that may sound insane, the simple math behind the US treasury’s debt projections also place gold at over $3800 as debt swells to over $28 trillion by 2018, so BofA’s projection of $3500/oz. at that time is right in the ballpark.

So, how do you make sound wealth-preservation decisions in a world of fiscal illusion? It’s a tough question. Reggie Middleton answered it best recently; “You don’t have to an optimist or a pessimist, you have to be a realist.” In order to be a realist, you have to be able to look at real data and real information and then you simply have to use common sense. Numbers don’t lie, politicians do. I will help you with the mathematics of all this because that’s all it is. Then you can decide for yourself if you believe in math, or if you believe in magic.

Let’s start with a dose of cold, hard reality. It’s really tough to make good financial decisions when you’re being lied to. And you are being lied to. You are being lied to by our financial leaders. You are being lied to by their media. You can feel it. You can feel it when you listen to politicians and their promises on TV. You can feel it when you watch the government use scripted measures like CPI to gauge inflation that do not include food or energy, just so they can tell you there is none. You can see it in the policy decisions the powers-that-be come up with under the guise of “helping the people,” when in reality those policies are back-door bank bail-outs. You are being lied to about money and wealth protection. You are being led to financial slaughter by a pack of sociopaths at the Fed whose dual mandate is scripted as “keeping inflation in check and people employed,” but their policies say loud and clear that the dual mandate is instead to “punish savers and save too-big-to-fail banks.”

So, what is the end result of the Fed’s latest round of quantitative easing? Every month in 2013, the Fed will increase its balance sheet by $85 billion, consisting of $40 billion in MBS, and $45 billion in 10-30 year treasuries, or the natural monthly supply of longer-dated issuance. The Fed will therefore monetize roughly half of the US budget deficit in 2013.

Putting it all together, the Fed’s balance sheet will increase from just over $2.8 trillion currently, to $4 trillion on December 25, 2013.

A total increase of $1.17 trillion.

This is what the Fed’s balance sheet will look like:

And here is the price of gold relative to the Fed’s balance-sheet:

As clear as day, these charts illustrate that QE3 is truly the gift that keeps on giving if you are a holder of gold.

They call it “Quantitative Easing.” And this would be round three. The reason QE is like the gift that keeps on giving for a holder of gold is because it blatantly debases the US dollar. Allow me to illustrate:

Round one (QE1) started November 25, 2008 and ended March 31, 2010. During that 17-month period, a gallon of gas rose from $1.75 to $2.75 and gold rose from $725/oz. to $1125/oz.

QE2 was started Nov 3, 2010 and lasted seven months until June 30, 2011. During the seven months of QE2, gas prices rose from $2.80 to $3.60 and gold from $1325 to $1700. QE2 was also marked by massive global food inflation and global riots. QE2 ended June 30, and we have had no further ‘major’ balance sheet expansion until mid-September 2012.

In the last few weeks leading up to QE3 and the week after, gold rose 15%. The proof is in the numbers.

Math or Magic?

Let’s crunch the numbers and do some math, so you can use some useful data to make sound decisions.

During QE1 (17 months) gold rose 55% and gas rose 57%.

During QE2 (7 months) gold rose 28% and gas rose 28.5%.

Quite notably, your wealth in gold buys exactly the same amount of gas at the end of a QE period as it did at the beginning, but your USDs buy far less each time. I don’t think I really need to make the point that both gas and gold will rise in USD as QE3 really starts to kick in, do I? I think it would be much more challenging to try and figure out how much they will rise, as it is a given that they will.

QE1 consisted of $1.7 trillion spent mostly on mortgage-backed securities, and it caused a 55% spike in the price of both gas and real money (gold) over 17 months. That’s an average of $100 billion per month.

QE2 was $600 billion, spent buying US treasuries, and pushed both gold and gas 28% higher in seven months. That’s an average spend of $85 billion per month.

So let’s do the math, because we know exactly how much the Fed will be spending this time, just not for how long (although one can assume it’ll be a long time).

The numbers above tell me that roughly every $85 billion the Fed adds to its balance-sheet will cause a 2-3% rise in the price of gas and gold. If we know that the Fed is going to spend $85 billion a month ($40 billion in MBS purchases and the already $45 billion in treasuries), we can safely assume an approximate increase of over 20% per year in the price of both gas and gold as long as the Fed is adding to his balance sheet at that rate. Again, this latest round of QE-infinity has no spending limit and no time limit, much like the monetary cannon the European Central Bank shot in early September to try and save the deal over there.

QE3 Will Not Improve Labor; It will Ruin The Economy

This policy is complete insanity. It’s simple math puts gas prices in September, 2014 at 25-40% higher than in September, 2012 and well over $6. It puts gold in the $2350-$2500 range and past $1900 pretty quickly. It debases the US dollar significantly, again, and at a time when we need fiscal responsibility more than ever. But here’s the real insanity behind this kind of move and its perceived intentions: How does spending $40 billion a month buying toxic paper from banks even help the labor market anyway? How can the Fed even get away with another huge lie and distortion like this one?

Not that I think it’s a good idea to print money and replace debt for credit (as credit dies) to try and resuscitate capital markets. But I don’t understand why, if the Fed is going to spend money to try and help labor, they don’t invest $40 billion a month into the Small Business Association? That money is federally guaranteed and would improve the labor market a whole lot faster.

I think I can answer my own question… because these policies aren’t really aimed at fixing the labor market or improving the real economy at all. These policies are designed to be bailouts for too-big-to-fail banks and to keep rates low so that the Fed can service $16 trillion in debt. This was a move that had complete panic all over it. It’s likely to cause gold to go to $3500 an ounce and, for those who like risk, maybe Ben gets the Dow to 15,000. But if there are still no jobs, and a cup of coffee if $5, and it costs over $100 to fill your gas tank, who’s it really helping?

Protecting Your Wealth from the Madness

To actually achieve sound wealth protection at this point, you need to look for true diversification (as opposed to banker diversification), by removing some of your wealth from “the system.” You need to get a portion of your wealth out of the insolvent banking institutions that don’t pay you any yield anyway, and then you need to buy some real money. Some grass-fed, non-GMO, organic, real MONEY. The unprocessed kind. The kind that is not attached to all the political lies and corporate greed. Money free of debt and that can’t be printed by criminals. The kind that has outlasted every paper fiat currency ever invented by man for over 5000 years.

In all honesty, if you can’t see the writing on the wall at this point in the game, and especially after round number QE3 of failed policy that does nothing for the real economy but blow up asset bubbles, you may never see it.

And if you can’t use simple math to uncover the truths of the sleight-of-hand coming from the central-bank magicians, you may just be doomed to a life of fiscal frustration and hardship. “The greatest trick central bankers ever pulled was convincing the world that they work for the public and not for the banks.” The Fed may work for the banks and not you, but your wealth exists to serve you, not them. Your wealth must outlast you and, hopefully, they’ll be some to pass to those you love. Your wealth does not exist to support a broken, criminally-run and insolvent system.

If you presently do not own any gold, then you do not have the luxury of time. The foundation and thus the safety of our monetary, banking and financial systems has never been less sound. Never. The move we saw the Fed pull with QE3 is a clear and perfect example of that.

While the media may try and convince you otherwise, I hope you have gained the ammunition to see the truth and make some decisions about how you will prepare for the inevitable math of the future. Again, you don’t have to be an optimist to make money, and you don’t have to be a pessimist to protect it. You need to be a realist.

Romney can't keep his word… here are his biggest flip/flops… CHECK THE REAL ROMNEY LIAR: http://clnk.me/1y9bQ.

Great reality check article. Wake up people. This ship called Amerika is going down. Hope you are on the other one whose Commander in Cheif and Captain is Jesus Christ, who was and is a true Jew, and so are you, whether jew or gentile, if you are in Him.

They aren't just criminals, they're jew criminals, doing what comes naturally. And their appeasers – usually known as "Old White guys" help them to achieve their ancient goal of taking over the world and ruling the goy (us) as animals with which they can do whatever their twisted minds come up with.