By thetruthwins

–

Most Americans still appear to be operating under the delusion that the “recession” will soon pass and that things will get back to “normal” very soon. Unfortunately, that is not anywhere close to the truth. What we are now witnessing are the early stages of the complete and total breakdown of the U.S. economic system. The U.S. government, state governments, local governments, businesses and American consumers have collectively piled up debt that is equivalent to approximately 360 percent of GDP. At no point during the Great Depression (or at any other time during our history) did we ever come close to such a figure. We have piled up the biggest mountain of debt that the world has ever seen, and now that gigantic debt bubble is beginning to pop. As this house of cards comes crashing down, the economic pain is going to become almost unimaginable.

Most Americans still appear to be operating under the delusion that the “recession” will soon pass and that things will get back to “normal” very soon. Unfortunately, that is not anywhere close to the truth. What we are now witnessing are the early stages of the complete and total breakdown of the U.S. economic system. The U.S. government, state governments, local governments, businesses and American consumers have collectively piled up debt that is equivalent to approximately 360 percent of GDP. At no point during the Great Depression (or at any other time during our history) did we ever come close to such a figure. We have piled up the biggest mountain of debt that the world has ever seen, and now that gigantic debt bubble is beginning to pop. As this house of cards comes crashing down, the economic pain is going to become almost unimaginable.

Already, things are really, really, really bad out there. Unemployment is at shockingly high levels. Foreclosures and personal bankruptcies continue to set new all-time records. Businesses are being shut down at a staggering rate, more than 40 million Americans are on food stamps, and the U.S. government continues to pile up debt at blinding speed.

There is no use sugar-coating it.

The U.S. economy is collapsing.

The following are 40 bizarre statistics that reveal the truth about the collapse of the U.S. economy….

1 – According to one shocking new survey, 28% of U.S. households have at least one member that is looking for a full-time job.

2 – A recent Pew Research survey found that 55 percent of the U.S. labor force has experienced either unemployment, a pay decrease, a reduction in hours or an involuntary move to part-time work since the recession began.

3 – There are 9.2 million Americans that are unemployed but that are not receiving an unemployment insurance check.

4 – In America today, the average time needed to find a job has risen to a record 35.2 weeks.

5 – According to one analysis, the United States has lost 10.5 million jobs since 2007.

6 – China’s trade surplus (much of it with the United States) climbed 140 percent in June compared to a year earlier.

7 – This is what American workers now must compete against: in China a garment worker makes approximately 86 cents an hour and in Cambodia a garment worker makes approximately 22 cents an hour.

8 – According to a poll taken in 2009, 61 percent of Americans “always or usually” live paycheck to paycheck. That was up significantly from 49 percent in 2008 and 43 percent in 2007.

9 – According to a recent poll conducted by Bloomberg, 71% of Americans say that it still feels like the economy is in a recession.

10 – Banks repossessed 269,962 U.S. homes during the second quarter of 2010, which was a new all-time record.

11 – Banks repossessed an average of 4,000 South Florida properties a month in the first half of 2010, up 83 percent from the first half of 2009.

12 – According to RealtyTrac, a total of 1.65 million U.S. properties received foreclosure filings during the first half of 2010.

13 – The Mortgage Bankers Association recently announced that demand for loans to purchase U.S. homes has sunk to a 13-year low.

14 – Only the top 5 percent of U.S. households have earned enough additional income to match the rise in housing costs since 1975.

15 – 1.41 million Americans filed for personal bankruptcy in 2009 – a 32 percent increase over 2008.

16 – Back in 1950 each retiree’s Social Security benefit was paid for by 16 workers. Today, each retiree’s Social Security benefit is paid for by approximately 3.3 workers. By 2025 it is projected that there will be approximately two workers for each retiree.

17 – According to a new poll, six of 10 non-retirees believe that Social Security won’t be able to pay them benefits when they stop working.

18 – 43 percent of Americans have less than $10,000 saved for retirement.

19 – According to one survey, 36 percent of Americans say that they don’t contribute anything to retirement savings.

20 – According to one recent survey, 24% of American workers say that they have postponed their planned retirement age in the past year.

21 – The Conference Board’s Consumer Confidence Index declined sharply to 52.9 in June. Most economists had expected that the figure for June would be somewhere around 62.

22 – Retail sales in the U.S. fell in June for a second month in a row.

23 – Vacancies and lease rates at U.S. shopping centers continued to get worse during the second quarter of 2010.

24 – Consumer credit in the United States has contracted during 15 of the past 16 months.

25 – During the first quarter of 2010, the total number of loans that are at least three months past due in the United States increased for the 16th consecutive quarter.

26 – Things are now so bad in California that in the region around the state capital, Sacramento, there is now one closed business for every six that are still open.

27 – The state of Illinois now ranks eighth in the world in possible bond-holder default. The state of California is ninth.

28 – More than 25 percent of Americans now have a credit score below 599, which means that they are a very bad credit risk.

29 – On Friday, U.S. regulators closed down three banks in Florida, two in South Carolina and one in Michigan, bringing to 96 the number of U.S. banks to be shut down so far in 2010.

30 – The FDIC’s deposit insurance fund now has negative 20.7 billion dollars in it, which represents a slight improvement from the end of 2009.

31 – The U.S. federal budget deficit has topped $1 trillion with three months still to go in the current budget year.

32 – According to a U.S. Treasury Department report to Congress, the U.S. national debt will top $13.6 trillion this year and climb to an estimated $19.6 trillion by 2015.

33 – The M3 money supply plunged at a 9.6 percent annual rate during the first quarter of 2010.

34 – According to a new poll of Americans between the ages of 44 and 75, 61% said that running out money was their biggest fear. The remaining 39% thought death was scarier.

35 – One study found that as of 2007, the bottom 80 percent of American households held about 7% of the liquid financial assets.

36 – The bottom 40 percent of all income earners in the United States now collectively own less than 1 percent of the nation’s wealth.

37 – The number of Americans with incomes below the official poverty line rose by about 15% between 2000 and 2006, and by 2008 over 30 million U.S. workers were earning less than $10 per hour.

38 – According to one recent study, approximately 21 percent of all children in the United States are living below the poverty line in 2010 – the highest rate in 20 years.

39 – For the first time in U.S. history, more than 40 million Americans are on food stamps, and the U.S. Department of Agriculture projects that number will go up to 43 million Americans in 2011.

40 – A new Rasmussen Reports national telephone survey has found that just 23% of American voters nationwide believe the federal government today has the consent of the governed.

The main reason that the mirage of a recovery hasn’t faded completely are twofold: Nothing like this have ever happened in anyone lifetimes of memory. The general public have no reality on the situation because people are a-customised to “learning from experience”. No experience = no reality. The second reason is denial. Who would want to believe this information, who would want to wake up in a real life horror movie that they can’t turn off or escape from?

It’s all part of their grand plan

wow! what the hell? so thing’s are worse then they’ve ever bin? unlike um what” killing gods kid, cooking jew’s,indians,blacks, and hey how about them sailom witch’s, the kid’s at kent state! oh no this time for real ! God is good go ahead die, just flat out lay down and die,it is what it is,he’s got your back all you got to do is believe, and dont eat the damn apples,why you think they keep given em to teacher’s ! BOO!

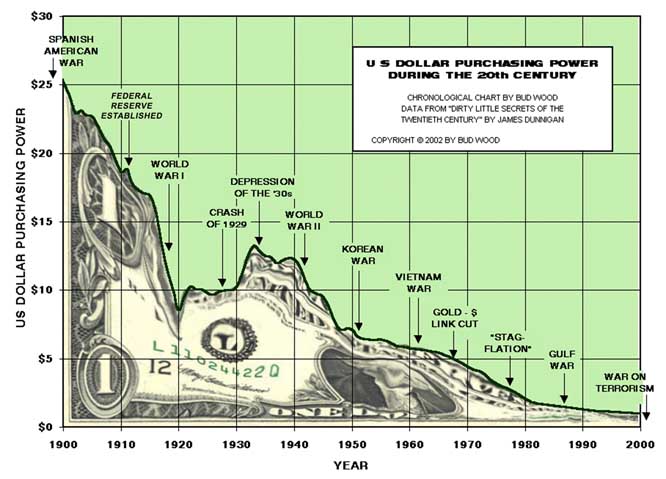

I think the purchasing power of the US$ or the Imports by itself is no the problem, all currencies have declining purchasing power because of the normal increase in prices and inflation , but the major economic problems come from the declining growth in GNP, the deficit of the federal government and deficit in the trade balance and balance of payments. The US government is spending much more than what it can get from revenues and the Americans import more than their exports, much of the government spending goes to non income generating projects especially wars and external interventions in other countries.

If the US government will close the door for imports other countries will do the same against US and the major US industries will collapse, international trade is good because it makes Americans get goods from abroad with higher quality and lower cost and can let US manufacturers sell larger quantities and with better prices, but there has to be a balance between imports and exports. I n addition to that the US gov better invest in its economy than to finance interventions in other countries and give up the imperial country ideals that harmed the US economy and people for long years, that can help the economic growth and decrease unemployment and poverty rates and increase the standards of living for Americans.

Dear Alexander,

You are spot on, and I could not have said it better.

Plus you are a more eloquent writer than I….

Frank

http://www.AmericanSurvival101.com

If I can see the oncoming disaster coming at us with the throttle wide open, then why cant the rest of the Country? Or does everyone see it, but try to delude themselves into thinking that it’s not really happening?

This all started with John F. Kennedy when he gave the okay allowing approximately 5% of all manufactured goods to be imported. Each succeeding President opened the door a little more until not only was the door opened wide, it was taken off the hinges and thrown away.

In less than a single generation, the greatest transfer of wealth in all of human history has taken place…America has become a beggar nation.

Today the so-called American manufacturers import everything from Japan, Korea, China, and Mexico. Sure they lowered the price of goods due to paying slave wages in other lands while making personal fortunes for themselves and bankrupting the United States in the process.

Even if an imported automobile could sell for $100, who could afford to buy it at that price in the United states if everyone is unemployed?

Another point….. Contrary to popular belief, there is not one Japanese automobile or truck made in the U.S.A. ;assembled here, yes, but made here? Never!

Where are the Japanese steel rolling mills, their foundries, transmission and engine plants? Where are their tool and die shops and metal stamping plants? They are all back in Japan. Those are the types of industries that generate off-shoot employment, not sterile assembly plants where the sticking together of trucks and automobiles can be done by little old ladies from the kits shipped in from Japan.

The only hope America has, is getting a REAL President, a STRONG President who will slap an import tax on so high that industry will not find it worthwhile to be in the import business and go back to manufacturing in the United States instead.

Then, and only then will the United States have full employment.