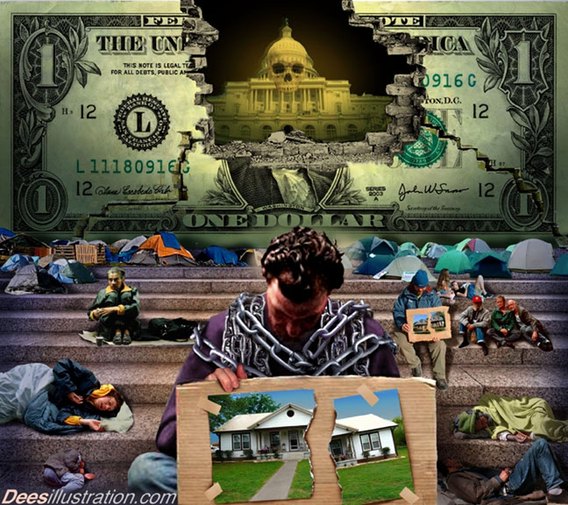

As I have repeatedly pointed out, the American military and intelligence leaders say that debt is the main national security threat to the U.S.

As I noted in February 2009 and again last December, a number of high-level officials and experts are warning of financial crisis-induced violence … even in developed countries such as the U.S.

And as I pointed out in February of this year, the U.S. runs the risk of going the way of the Habsburg, British or French empires:

Leading economic historian Niall Ferguson recently wrote in Newsweek:

Call the United States what you like—superpower, hegemon, or empire—but its ability to manage its finances is closely tied to its ability to remain the predominant global military power…

This is how empires decline. It begins with a debt explosion. It ends with an inexorable reduction in the resources available for the Army, Navy, and Air Force…

If the United States doesn’t come up soon with a credible plan to restore the federal budget to balance over the next five to 10 years, the danger is very real that a debt crisis could lead to a major weakening of American power.

The precedents are certainly there. Habsburg Spain defaulted on all or part of its debt 14 times between 1557 and 1696 and also succumbed to inflation due to a surfeit of New World silver. Prerevolutionary France was spending 62 percent of royal revenue on debt service by 1788. The Ottoman Empire went the same way: interest payments and amortization rose from 15 percent of the budget in 1860 to 50 percent in 1875. And don’t forget the last great English-speaking empire. By the interwar years, interest payments were consuming 44 percent of the British budget, making it intensely difficult to rearm in the face of a new German threat.Call it the fatal arithmetic of imperial decline. Without radical fiscal reform, it could apply to America next.

And William R. Hawkins (formerly an economics professor at Appalachian State University, the University of North Carolina-Asheville, and Radford University) fills in some details on the fall of the Hapsburg empire:

Spain was the first global Superpower…With Spain as its political base, and gold and silver flowing in from its American colonies, the Hapsburg dynasty became the dominant power in Europe. It controlled rich parts of Italy through Naples and Milan, and Central Europe from the Netherlands through the Holy Roman Empire to Austria. In the 16th century it added the far distant Philippine islands to its empire. The Hapsburgs held off the Ottoman Turks, whose resurgent wave of Islamic conquest in the 16th century swept across the Balkans and nearly captured Vienna.

The Hapsburgs went into decline in the 17th century, and while any such momentous event has many causes, for our purposes the focus will be on the economic collapse of Spain, which not only sapped the empire of strength but served to build up the power of its rivals.

The demands of empire required a strong and growing economy, but Spain did not keep up with the economic expansion that was taking place in other parts of Europe. Madrid’s financial base fell out from under its empire. Spain could continue to consume in the short term because of the flow of precious metals from American mines, but it could not produce the goods it needed at home, which in the long-run proved fatal to its standing as a Great Power and as an advanced society.

Spanish imports were double exports and the precious metals became scarce within weeks of the arrival of the American treasure fleets as the money flowed to Spain’s many creditors. What industry there was, along with banking and shipping, was in the hands of foreign owners. As a modern historian, Jaime Vicens Vives, has concluded, “This was one of the fundamental causes of the Spanish economy’s profound decline in the seventeenth century, maritime trade had fallen into the hands of foreigners.” This, plus the “opening of the internal market to foreign goods,” produced a “fatal result.” Spain’s exports were at the same time under heavy pressure by competitors in third country markets. A nation that cannot control its domestic market will seldom be able to sustain itself in foreign markets, which are inherently less accessible and more unstable.

Yet, Spanish leaders were deluded by a sense of false prosperity. This is testified by the statement of a prominent official, Alfonso Nunez de Castro in 1675: “Let London manufacture those fine fabrics of hers to her heart’s content; let Holland her chambrays; Florence her cloth; the Indies their beaver and vicuna; Milan her brocade, Italy and Flanders their linens…so long as our capital can enjoy them; the only thing it proves is that all nations train their journeymen for Madrid, and that Madrid is the queen of Parliaments, for all the world serves her and she serves nobody.” A few years later, the Madrid government was bankrupt. The Spanish nobleman had foolishly elevated consumption, a use for wealth, above production, the creation of wealth.

Historians have traced the flow of Spanish gold and silver across the markets of Europe. Those who “served” Spain by establishing industries to manufacture goods for the Spanish market gained the money. Spain’s rivals, France, Holland (which started a successful revolt in 1568) and England, prospered by their trade surpluses, and reinvested the money to expand their own capabilities. Another modern expert on Hapsburg history, Henry Kamen, has cited contemporary sources who referred to 17th century Spain as “the Indies for the foreigner.” The military empire of the Hapsburgs became the economic colony of other powers, or, to use a current phrase, Spain was the “engine of growth” for the rest of the continent.

Where there were jobs and prosperity, there was also rapid population growth, and rising tax revenue. Rival powers were able to field and finance military forces that could defeat the once superior Spanish forces both on land and at sea. The irony of this is that Spain was ruled by a warrior aristocracy tempered by centuries of constant warfare against Islamic hordes and Christian heretics. These nobles looked down on merchants and manufacturers and disparaged their mundane professions only to find that without a strong domestic business class they could not afford the fleets and armies that guarded the empire they had built.

Today, the American “empire” is also trying to consume more than it produces. The U.S. trade deficit is nearing Spain’s nadir of imports being double exports. Both government spending and private consumption are financed heavily by debt. Washington is printing money, the modern equivalent of digging gold out of the ground, rather than earning the means to pay its bills. And the political and military elites are apparently indifferent to the fate of domestic business and industry. Americans must learn … from the Spanish experience … and take corrective action while they still can.

The United States Joint Forces Command – which oversees military operations in the North Atlantic geographic area and supports the other commanders-in-chief in their geographic regions around the world – is now echoing all of these themes.

As World Net Daily reported Thursday:

The Joint Operating Environment 2010 report, or JOE 2010, released March 15 by the United States Joint Forces Command, or USJFCOM, warned that “even the most optimistic economic projections suggest that the U.S. will add $9 trillion to the [national] debt over the next decade, outstripping even the most optimistic predictions for economic growth upon which the federal government relies for increased tax revenue.”

The USJFCOM expressed concerns that the burgeoning U.S. national debt represented a threat to U.S. national security.

“Rising debt and deficit financing of government operations will require ever-larger portions of government outlays for interest payments to service the debt,” the JOE 2010 cautioned. “Indeed, if current trends continue, the U.S. will be transferring approximately 7 percent of its total economic output abroad simply to service its foreign debt.”

To underscore its concern, the USJFCOM cited an alarming litany of historic examples, including the following:

- Habsburg Spain defaulted on its debt 14 times in 150 years and was staggered by high inflation until its overseas empire collapsed;

- Bourbon France became so beset by debt due to its many wars and extravagances that by 1788 the contributing social stresses resulted in its overthrow by revolution;

- Interest ate up 44 percent of the British government budget during the interwar years 1919-1930, inhibiting its ability to rearm against Germany.

“Unless current trends are reversed, the U.S. will face similar challenges, anticipating an ever-growing percentage of the U.S. government budget going to pay interest on the money borrowed to finance our deficit spending,” the JOE 2010 concluded.

Of course, debt is not the only threat to empire … or the only indicator of a nation’s economic malaise. In that regard, the crash in Italy in the 1340s and the hyperinflation in Hungary in 1946 are instructive.

SUMMARY

HOW TO REVERSE WORLD RECESSION IN MATTER OF DAYS

A Method to Address Economic Recession, Remove Poverty, Terrorism, Improve Law and Order, Reduce Drug Abuse, Inflation And Taxes in an Interest Free Based Economy.

By: Dr. Niaz Ahmed Khan, FRCS, PhD

ABSTRACT:

I have developed a new financial instrument which will be much more valuable than the bonds or the treasury bills government sells in the open market to raise much needed funds to run the country. These are all interest based instruments and can only be used by institutions. The instrument I am proposing is without interest and will be used by everybody to purchase goods and services in the government and private sector resulting in up to 60% discounts. This is why these will be massively bought up front in large amounts in the shortest period of time of one month to run the country for at least a year and much more by the end of the year.

SUMMARY OF THE BOOK:

The world is facing many challenges with no solution in sight.

The main cause of all these ills is the POVERTY. Float bonds which can be used by everybody rich or poor and are not debt to the state so there is no question of interest.

How: Take the example of USA which is going through a great recession.

USA borrows money by selling treasury bills and the interest based bonds. The suggestion is to sell these bonds on non interest basis.

1. Buy all goods and services under govt control with these bonds and these bonds will replace dollar with bonds.

2.10 million duty waved off.

3.100 million dollars prize draw from the bonds held by the public every day.

EXAMPLE: ONE dollar buys 5 bonds on the condition that the amount should be $100,000 or multiple of it. Fewer amounts will get the rate of four and three. This massive discount period is only for first month at the start of the implementation of this system. In the second month the rate will be 4 but the rate of 3 will apply to subsequent months for the same amount.

WHERE THESE BONDS WILL BE USED?

1. All state controlled services and commodities.

EXAMPLE: A bill of (any service or Commodity) $100 can be paid with 200 bonds and there will be no exception to this rule. A NET DISCOUNT OF 60%.

A simple formula will apply: Total bill in dollars x2 is the number of bonds surrendered. Price in bonds will not be less than the cost price but without the direct indirect taxes and the duties which are added to the present cost to make it very expensive.

It will attract at least 50 million people to take this opportunity as early as possible. And if one is sure of making 100% profit within 30 days there will be many more that will help themselves.

RESULT: Government gets at least $5 trillion within a very short period of time of few days and much more in the rest of the year. THIS IS NOT A DEBT AS STATE HAS SOLD BONDS (Commodity) WHICH IS AN ALTERNATE CURRENCY AND DO NOT CARRY ANY INTEREST. One immediately thinks who will bear the loss and this loss to the state will not be more than total year budget of $2.5 trillion which it collects in one year with all the taxes and the duties but the bond price is simply a cost price without any kind of tax or duty. So there is a net gain of approximately 2.5 trillion within a short period of time. First floodgate of money has been opened.

WHO WILL SELL THESE BONDS?

State will float tenders to select a private agency (USMF) UNITED STATES MONITORY FUND JUST A NAME GIVEN TO THIS ORGANIZATION with the lowest bid WHERE AS second, third and fourth bidders will be auditors of USMF. This agency will employ at least 20 million unemployed on 10% commission basis and without any salary. These agents will have to pay $500 as an annual fee to USMF in order to build the infrastructure for the sale of bonds. Agents’ quota will be $300,000 per month or they will be allowed to sell their whole year quota in one day or in a month. This will only materialize if the agent shares his commission with the buyer. Greater the share of commission quicker the sale. The investor or a buyer will sell these bonds at the same rate of 5 per dollar and his bonds will sell like hot cakes every day as there is no condition of the amount of money to purchase the bonds. In this way even the poorest person will get the same or near the same rate as the investor earns a profit from the commission which he takes from the agent and makes almost 100% profit by only investing $100,000. He will sell these bonds repeatedly and will keep almost 6% profit every day till the demand lasts. NOW THINK HOW MUCH FUNDS STATE HAS ACCUMULATED Much more than few years budget in matter of only one month.

FLOOD GATES OF MONEY AND TURNING POINT

This is the second flood gate of money and there are still four more floodgates of money yet to open. So at the end of 30 days or even much earlier the government declares tax free country for ever. With the removal of all kinds of direct and indirect taxes and duties the price of oil electricity telephone and of all other services under government control is now almost 60% less than before as these are being purchased by bonds (which is the cost price) and not with dollars. The production cost of everything has come down tremendously.

SECOND OPTION

STATE ALSO OFFERS 10 MILLION DUTY FREE IF ONE DEPOSITS $100,000 NON REFUNDABLE. THIS BRINGS OUT ALL THE BLACK AND SPARE MONEY WHICH STATE WAS NOT ABLE TO GET BEFORE AND AS THERE IS NO TAX AND HENCE NO TAX EVASION SO ALL THE MONEY IS WHITE AS IT IS BEING GIVEN TO GOVERNMENT.

This was the third floodgate of money which is even bigger than the first one and the exact amount is impossible to asses unless the system is implemented.

In order to provide cheap bonds throughout the year government offers three types of registration fees.

1. Pay $100,000 in the start of the year and get the rate of 5 for the rest of the year and this will suit the professional’s and salaried person’

2. Pay $10,000 yearly and get 20,000 new bonds at the rate 5 every month but one has to collect 10,000 bonds (equal to fee) to get this cheap rate throughout the year. Higher the registration fee more the entitlement of cheap bonds. This registration will suit any small time business who will sell his product cheaper provided 15% bonds are also paid with rest of cash money by the customer SEE THE NEXT REGISTRATION FOR FURTHER EXPLANATION OF15%BONDS. This will apply to all goods in private sector and does not apply to the government sector. This is a big incentive to accept bonds in the private sector as the business accepting more bonds will have more business than the trader not accepting the bonds so the bonds market will multiply and there will be a constant need for bonds in the open market.

3. Third type of registration will be of $100,000 which will entitle the business to sell its products through USMF. The value of merchandise sold through this source will help the business to get the 5 bond per dollar rate or opt for the duty free option equal the amount sold. But with one condition of surrendering 15% bonds at each sale in dollars.

EXAMPLE:

MERCHANDISED SOLD THROUGH USMF $1000. BONDS SURRENDERED 150 ARE DEPOSITED IN STATE ACCOUNT TO BE SOLD AGAIN SO THE CYCLE OF BONDS IS ESTABLISHED .A receipt of bonds surrendered is obtained from USMF for evidence of sale of merchandise and this receipt will entitle the traders to get cheap bonds or the duty free option throughout the year BUT THE SAME RECEIPT CAN BE USED ONCE ONLY.

WHAT IS THE BENEFIT TO BUSINESS?

1. CHEAP BONDS THROUGH OUT THE YEAR

2. DUTY FREE OPTION WILL HELP INDUSTRY.

3. The quota which can be sold is ten times the amount of Registration but not more unless the registration fee is increased. Now all the business will opt for this registration in order to reduce the cost of production. These 15% bonds the business will get back through a chain of dealers sub dealers and ultimately the customer will pay this bond portion as he will get the end product very cheap because of tremendous cut in the cost of production by the factors already mentioned. This will replace the GST or the VAT or the two price system seen all over USA. Almost everybody will sell their product through this channel as it will be much costlier to sell the product outside this system as cheap bonds are not available otherwise.

According to rough estimate at least $10 trillion transactions are carried out every day in US and at each transaction 15% bonds are being surrendered, the price 15 bonds is $3. So 3% of 10 trillion will be $300 billion which goes into government account without any compulsion every day (UNBELIEVABLE). This is the fourth floodgate of money AND IS CALLED THE GOLD MINE. Now the state is sitting in the driving seat and all the money in banks of private sector has been transferred into government account and banks are no more the lenders but are borrower from the state which is the only source left and will invest in business with sound feasibility study checked by the state bank. The state will offer to invest 80% and the bank will bring investor who is willing to pool rest 20%. This 20% will be deposited in the bank and the bank will oversee the running the business, running expenses will be given to the investor from its share of 20%. There will be no collateral and share of the profit and loss will be shared in the ratio of 60 and 40. The bank will share the 60% with the investor and 40% will go to state funds and the state will provide everything under its control below cost which will farther reduce the cost of production and at the same time will MARKEDLY improve the profit margins OF ALL THE BUSINESSES. No major business can refuse this offer. Any bank showing repeated loss will go out of business as there will be no more funds available from the government source and all other interest based sources are not available any more. Interest based banking is gone forever or it may be at a very small scale and the state will not offer loans on interest as these are not any more profitable and risk free as there is no collateral. The amount of profit government will share will be unimaginable and this is the 5th flood gate opened.

THEN WHY NOT INVEST ON PROFIT AND LOSS SHARING BASIS

Last but not the least government will acquire all the land on lease without any force and will provide all the needs to the formers THROUGH CORPORATE FARMING SECTOR HIRED BY THE STATE below cost and will become the shareholder according to the mutual contract with the land owner this is the 6th flood gate of money opened.

DRUG ABUSE ELIMINATED

When all the possible land is being cultivated by best agriculture engineers there will be much better yield and much more profit to land owner then who will not join hands with the government.

THE OBVIOUS BENEFIT WILL BE NO MORE POPPY CULTIVATION IN COUNTRIES WHICH ARE POOR AND LARGELY DEPEND ON THE POPPY CROP. NOW THERE IS NO MORE POPPY AND NO MORE DRUGS.

All the above claims have been proved to be true except the terrorism.

HOW TERRORISM WILL BE ELIMINATED?

We have to look at root cause and it is POVERTY and NOT the religion which is being falsely blamed. The going rate for a suicide bomber is $1,000 in Pakistan, Iraq and in Afghanistan. Can one believe that anyone having at least two meals a day will blow himself? Never the areas of the countries where these attacks are happening are extremely poor and the extremist elements who themselves are or were poor exploit these very poor people to carry out attacks for money to save their families dying from hunger and this is an open secret. Extreme elements has large force that is recruited from poor areas as there in no job anywhere and they provide these raw recruits with only food and shelter and at same time brainwash them and train some of them to carry out these attacks by giving them enough money in their lives to support their dependents. You might mention few isolated cases of being well to do and still carried out these attacks. Once the poverty is removed in these areas by implementing this system these attacks will come to an end immediately. This system is not only meant for USA but will be easily applicable to every country.